On a hot August afternoon, millions of air conditioners hum, electric vehicles charge in driveways, and computers connect to AI platforms hosted in data centers. Together, they create enormous demand that strains local electric power grids to their limits. Traditionally, the only way to guard against blackouts and skyrocketing bills was to fire up another gas plant to boost supply. Today, a cleaner and more accessible solution may already be inside our homes

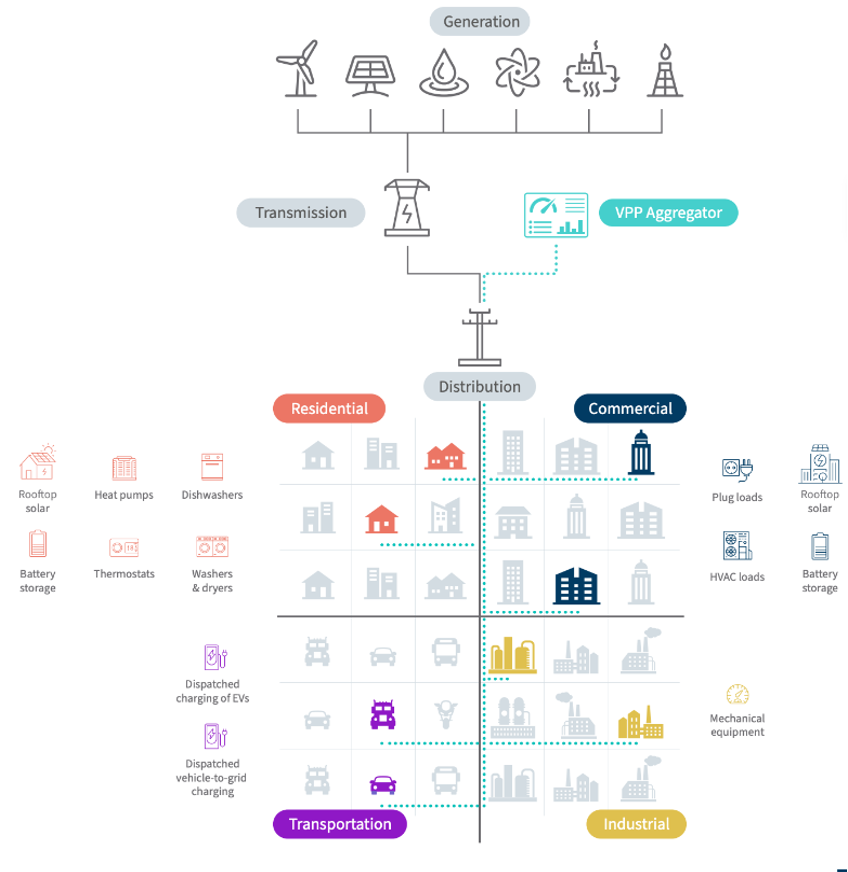

Smart thermostats, EV chargers, rooftop solar panels, and home batteries are becoming critical to the grid. Known as distributed energy resources (DERs), these small devices can generate, store, or shift electricity. Alone, their capacity is modest, but aggregated through software into a Virtual Power Plant (VPP), their sum of energy conserved and generated rivals the output of a traditional power plant.

Here’s how it works: homeowners enroll their devices with an aggregator, who uses software to monitor usage, forecast regional demand, and control their devices, pooling the capacity of devices among several households into a single VPP resource. To grid operators, this capacity is equivalent to a conventional plant that can be dispatched when the grid is stressed or bid into wholesale markets. Once dispatched, VPPs tap into multiple revenue streams from clean generation, demand response, market sales, capacity, and ancillary services.

DERs are vital to maintaining a reliable and clean grid amid rising demand and frequent shortages. To unlock their full potential, consumers must understand the financial benefits, and policymakers must sustain a framework that supports widespread adoption.

Rocky Mountain Institute Virtual Power Plant

The Grid Needs a Makeover

Many of the devices that now serve as distributed energy resources (DERs) are relatively new, but the key enabler of Virtual Power Plants (VPPs) has been changes in U.S. energy regulation.

For most of U.S. history, electricity came from large, centralized coal, gas, nuclear, or hydro plants delivered over transmission lines. In the early 20th century, the government declared electricity a natural monopoly, granting utilities control over generation, transmission, and distribution under state oversight. By the 1970s, policymakers introduced competition, requiring utilities to buy power from independent generators. In the 1990s, federal regulators went further, mandating open access to transmission lines so these generators could compete in wholesale markets. Some states even allowed customers to choose among competing retail electric suppliers.

These reforms made electricity cheaper and more reliable, but blackouts and price surges are becoming increasingly frequent as a result of severe weather and demand that is sharply increasing due to data centers. Traditionally, grid operators relied on extra plants to provide energy reserves, but the scale of future demand is daunting: the U.S. will need over 200 GW of new peak capacity by 2030, 1.5 times the record peak demand of California and Texas combined. Building plants to cover this demand will take years, cost billions, and increase environmental burdens.

VPPs can offset part of this need by tapping the potential of DERs. Smart thermostats and EV chargers can cut or shift demand, while solar panels and batteries add distributed generation and storage. The Department of Energy estimates 80–160 GW of VPPs by 2030 could save $10 billion annually while returning value to consumers. But scaling requires wider household and business adoption, more aggregators, and regulatory support that ensures benefits are shared across participants. Progress so far reflects only the earliest shifts in energy market rules.

Making Space for Virtual Power Plants

Policy changes have laid the foundation for Virtual Power Plants (VPPs) to enter U.S. energy markets. In 2011, the Federal Energy Regulatory Commission (FERC) issued Order 745, requiring that demand reductions be paid the same wholesale price as electricity generation. In practice, this meant DERs like smart thermostats could turn down AC during peak hours, or EV chargers could pause charging when the grid was strained. These small actions reduce total load just like adding new generation, allowing aggregators and utilities to earn wholesale market payments and share value back with customers through bill credits or cash.

In 2020, FERC expanded this framework with Order 2222, which requires grid operators to let aggregated DERs bid directly into wholesale markets for energy, capacity, and ancillary services. VPPs can now submit offers just like a power plant: if the grid needs extra supply or reduced demand, the operator accepts the bid and pays the aggregator. This allows VPPs to compete with traditional generators, creating new revenue streams and reducing grid costs.

New Policy, New Opportunity

Orders 745 and 2222 didn’t just unlock new revenue streams—they opened the door to a variety of business models that give consumers more choice and fit different regional market rules. This diversity matters: the more ways households can participate, the easier it is to scale VPPs nationwide.

The first wave of companies was built around demand response, automating simple HVAC load reductions during peak hours (which made up about 31% of U.S. residential electricity use in 2023). Renew Home, anchored by smart thermostats, partnered with Google Nest and more than 100 utilities to turn millions of homes into dispatchable VPP capacity. Customers earn bill credits or rebates through their providers; for instance, Southern California Edison offers up to $75 a year for Nest users. Today, Renew has about 5 million households and 3 GW enrolled, with ambitions to reach 50 GW by 2030 as it expands its program to include more types of DERs and partnerships.

Retail Electric Providers (REPs)

In deregulated markets, retail providers compete to supply households with electricity purchased on wholesale markets. To protect themselves from price spikes, most providers buy long-term hedging contracts—financial agreements that guarantee a fixed supply price even if wholesale rates rise. While this reduces risk, it also locks providers into higher costs when wholesale prices fall, and those extra costs are passed on to customers.

Retail providers can automate customer DERs to draw energy at low-cost times and store it to be dispatched during peak hours, reducing reliance on hedges. In return, customers benefit by opting to enroll in time-of-use (TOU) rates (paying less during off-peak hours) and by receiving bill credits for allowing providers to control their DERs.

As a REP in Texas, David Energy’s Battery Optimization program illustrates how this model works in practice. With no statewide net metering and flexibility for REPs to design their own rate plans, companies rely on export credit programs and TOU pricing to return value to customers. Customers grant David permission to manage their home batteries, which automatically shift between charging, powering the home, or exporting to the grid based on real-time prices and conditions. When wholesale prices are low, the battery charges; when prices spike in the afternoon, it discharges to cover household demand or sell back to the grid. Customers choose among fixed, variable, or TOU rates for imported electricity, while exported power earns bill credits set either at a fixed value or tied to the amount of energy delivered.

Beyond bill savings, REPs can aggregate DERs into Virtual Power Plants (VPPs) and bid their capacity into wholesale markets for additional revenue streams. Tesla Electric, for example, aggregates thousands of Powerwall home batteries, paying customers participation credits while delivering clean peak capacity to the grid. For example, in August 2025, Tesla partnered with SunRun to form a virtual power plant (VPP) that delivered 535 MW to California’s grid during a two-hour event. The experiment powered hundreds of thousands of homes across the state and demonstrated that home batteries can respond quickly and reliably, reducing reliance on peaker plants.

Stand-Alone Companies

Order 2222 opened wholesale markets to DERs, creating space for VPP companies that operate independently of retail energy providers and utility bill credits. This independence is critical for scaling VPP capacity, since not every region allows retail competition or TOU rates. Stand-alone firms can bid directly into wholesale markets, making them more adaptable nationwide.

In states like New York, where utilities control TOU rates and REPs are heavily regulated, stand-alone aggregation services are especially effective. Strobe Power, for example, uses its proprietary software to pool DER capacity and sell it into the full range of VPP programs available through the regional wholesale market. Unlike REPs, Strobe pays customers directly in cash rather than through bill credits or discounted rates. Starpower takes a more unconventional approach. Its proprietary devices (smart plugs, home batteries, and EV chargers) connect to its platform and respond to grid signals. Users earn weekly tokens for participation, which can be used to pay electricity bills, while all activity is recorded on the Starpower blockchain, providing transparency.

Increasing customer adoption of DERs requires offering programs tailored to households’ needs. The more options available, the more households will join.

Transition to the Future of VPPs

FERC Orders 745 and 2222 laid the foundation, showing how policy can drive adoption by pairing financial incentives with space for innovation. But the potential remains largely untapped: as of 2023, fewer than 4% of U.S. households had rooftop solar, and fewer than 20% owned smart thermostats. Both the Department of Energy’s Pathways to Commercial Liftoff: Virtual Power Plants and the customer-centered “Bill of Rights” published by the Distributed Energy Resource Task Force (a coalition of policymakers, technologists, and entrepreneurs) point to the kinds of reforms needed to expand VPP capacity.

Scaling DER ownership requires educating customers on the benefits of VPP participation and making it more affordable. Financing must be easier to access, and payouts increased so DERs are valued not only for the energy they generate but also for the resilience and cost savings they provide. Additional rebates, tax credits, and revenue streams can help drive adoption.

On the supply side, regulations should be streamlined to help aggregation services grow. This includes speeding up permitting, training more workers to expand installation capacity, rewarding utilities for using DERs when it’s cost effective, and giving consumers the ability to choose their REP when it does not disrupt transmission.

Conclusion: Building the Grid of the Future

Virtual Power Plants prove that the path to meeting rising demand doesn’t have to rely on building new fossil plants. By turning DERs into dispatchable resources, VPPs provide cleaner, cheaper, and more flexible capacity. But realizing this potential requires supportive policy that lowers costs, streamlines participation, and values DERs for all they provide. With supportive policy and diverse business models to reach households across regions, VPPs can transform the grid into one that is cleaner, more resilient, and more affordable.

Reader Question

If Virtual Power Plants and DERs enable households and communities to form microgrids or go partially off-grid, what does that mean for the future role of utilities—and how might it affect their stance on VPP regulations and their willingness to make participation easier?